Command Palette

Search for a command to run...

AI-Trader:リアルタイム金融市場における自律型エージェントのベンチマーク評価

AI-Trader:リアルタイム金融市場における自律型エージェントのベンチマーク評価

Tianyu Fan Yuhao Yang Yangqin Jiang Yifei Zhang Yuxuan Chen Chao Huang

概要

大規模言語モデル(LLM)は、高度な推論能力およびツールの統合を活用することで、人間の専門家レベルの性能に近づく自律型エージェントとして、顕著な潜在能力を示している。しかし、完全に動的かつリアルタイムな環境における意思決定は依然として極めて困難であり、リアルタイムでの情報統合と適応的対応が求められる。既存の研究では構造化されたタスクにおけるリアルタイム評価メカニズムの探求が行われてきたが、特に金融分野において厳格なリアルタイム戦略的対応が求められる現実世界の応用において、体系的なベンチマークの欠如という重要なギャップが残っている。この課題を解決するために、我々は金融意思決定におけるLLMエージェント向けに、初めての完全自動化・リアルタイム性・データ汚染なしの評価ベンチマーク「AI-Trader」を提案する。AI-Traderは、米国株式、A株、暗号資産の3つの主要金融市場をカバーし、複数の取引粒度を用いてリアルな金融環境を再現する。本ベンチマークは、エージェントが人間の介入なしに自ら情報検索・検証・統合を行う完全自律型の最小情報パラダイムを実装しており、受信する情報は必須の文脈のみに限定される。我々は、3つの市場および複数の取引頻度において、6つの代表的なLLMを評価した。分析の結果、驚くべき知見が得られた。一般的な知能が自動的に有効な取引能力に直結するわけではないことが明らかとなり、多数のエージェントが低いリターンと弱いリスク管理を示した。また、リスク管理能力が市場間の堅牢性を決定する要因であり、高流動性市場では政策主導型の環境よりもAI取引戦略がより容易に超過リターンを達成できることを示した。これらの結果は、現行の自律型エージェントに存在する重大な限界を明らかにするとともに、今後の改善方向性を明確に提示している。

One-sentence Summary

The authors from the University of Hong Kong propose AI-Trader, a fully automated, live benchmark for evaluating LLM agents in financial decision-making across U.S. stocks, A-shares, and cryptocurrencies, introducing a minimal-information paradigm that forces autonomous real-time data synthesis; their evaluation reveals that general intelligence does not ensure trading success, with risk control emerging as key to cross-market robustness, especially in liquid markets, and underscores the need for improved agent design in dynamic financial environments.

Key Contributions

- We introduce AI-Trader, the first fully autonomous, live, and data-uncontaminated benchmark for evaluating LLM agents in real-world financial decision-making across three major markets: U.S. stocks, A-shares, and cryptocurrencies, with multiple trading granularities to simulate dynamic, real-time market conditions.

- The benchmark enforces a minimal information paradigm where agents receive only essential context and must independently search, verify, and synthesize live market data through autonomous tool use, eliminating human intervention and enabling rigorous assessment of real-time reasoning and adaptability.

- Evaluation of six mainstream LLMs reveals that general intelligence does not ensure trading effectiveness, with most agents showing poor returns and weak risk management, while risk control emerges as a key determinant of cross-market robustness, and excess returns are more achievable in highly liquid markets.

Introduction

Financial markets present a high-stakes, real-time environment where autonomous agents must integrate live information, reason under uncertainty, and make time-critical decisions—challenges that static benchmarks fail to capture. Prior evaluation frameworks often rely on fixed data, pre-defined workflows, or human-in-the-loop interventions, creating a disconnect between lab performance and real-world capability. These limitations hinder meaningful assessment of true autonomous decision-making, especially in dynamic domains like trading.

The authors introduce AI-Trader, the first fully autonomous, live, and data-uncontaminated benchmark for evaluating LLM agents across U.S. stocks, A-shares, and cryptocurrencies. Agents operate with minimal context—only current holdings, real-time prices, and access to tools—requiring them to independently search, verify, and synthesize live market data without any human guidance. This minimal information paradigm enforces rigorous demonstration of long-horizon reasoning, information retrieval, and adaptive strategy execution.

Their evaluation of six mainstream LLMs reveals that general intelligence does not imply trading competence: most agents deliver poor returns and exhibit weak risk management, with performance heavily dependent on market liquidity and structure. The study underscores that risk control is key to cross-market robustness and highlights the need for improved autonomous planning and adaptation in LLM agents. The open-sourced framework enables reproducible, high-fidelity assessment of agent capabilities in real financial environments.

Dataset

- The dataset spans three distinct financial markets: the U.S. stock market, China's A-share market, and the cryptocurrency market, enabling evaluation of agent generalization across different regulatory environments, investor behaviors, and market dynamics.

- Trading frequencies are supported at both hourly and daily intervals to capture diverse market behaviors and test agent responsiveness across time horizons.

- For the U.S. stock market, the dataset includes all 100 constituents of the Nasdaq-100 Index, representing large-cap, non-financial firms in technology, semiconductors, biotech, internet services, and consumer discretionary sectors. Key companies include Apple, Microsoft, NVIDIA, Amazon, Alphabet, Tesla, and Meta.

- The U.S. portfolio includes a cash asset with zero return to allow agents to practice risk-free capital allocation and demonstrate full portfolio management skills.

- The A-share market subset comprises the 50 stocks in the SSE-50 Index, selected from the Shanghai Stock Exchange. These are major blue-chip firms across finance, consumer goods, industrials, IT, energy, and healthcare, including Ping An Insurance, Kweichow Moutai, and China Merchants Bank.

- Both market environments are designed to reflect real-world conditions: the U.S. market emphasizes sensitivity to macroeconomic factors and technological innovation, while the A-share market highlights macro-driven volatility, sector rotation, and non-stationary behavior.

- The authors use the data in a training and evaluation framework where agents are trained on a mixture of market subsets with dynamically adjusted ratios to simulate cross-market adaptability.

- Data is processed to ensure consistent time alignment across markets, with no external data augmentation.

- No cropping is applied; full historical price and volume data are used for each asset.

- Metadata includes asset identifiers, sector classifications, market capitalization tiers, and index membership to support structured analysis and model interpretation.

Method

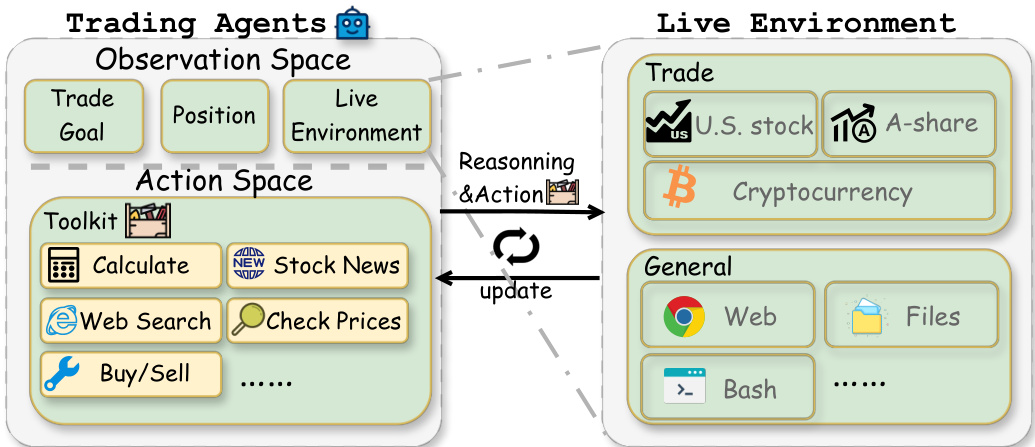

The authors leverage a modular architecture for AI-Trader, designed to support autonomous, adaptive trading agents within a unified and extensible framework. The system operates as a closed-loop process, where agents continuously observe market conditions, reason about potential actions, and execute trades, all while interacting with a live environment through a standardized toolkit. This architecture is structured around three primary components: the agent's observation and action spaces, the toolkit of available tools, and the live environment that simulates real-world trading constraints.

As shown in the figure below, the agent's observation space encompasses key market data such as current asset prices p and the agent's portfolio holdings s, forming the initial observation o0. This base information is augmented dynamically through tool invocations, which provide additional data such as detailed stock indicators πi and general market news i, resulting in a comprehensive observation ot at each time step. The agent's reasoning process, guided by the ReAct paradigm, operates autonomously, generating natural language traces that articulate its decision-making logic. These traces are recorded to ensure transparency and reproducibility, enabling researchers to analyze the agent's behavior in complex financial contexts.

The action space is constrained to three discrete actions per asset: buy, sell, or hold. The agent's policy function at=f(ot,rt) maps the current observation ot and reasoning rt to an executable action, ensuring decisions are both autonomous and compliant with real-world constraints such as liquidity and regulatory rules. If an action would violate these constraints, the system triggers a self-correction mechanism, requiring the agent to re-evaluate and generate a new, feasible decision.

The toolkit, which includes tools for checking prices, performing web searches, retrieving stock news, executing trades, and performing calculations, is designed to be modular and extensible. Each tool is built upon the Model Context Protocol (MCP), enabling seamless integration and adaptation across different asset classes and trading frequencies. The Trade tool, for instance, enforces market-specific rules such as lot-size requirements and updates portfolio holdings and cash balances in real time, ensuring accurate and auditable trade execution. The interaction between the agent and the live environment is bidirectional: the agent receives updated observations from the environment after each action, and the environment is updated with the agent's decisions, maintaining the integrity of the closed-loop system.

Experiment

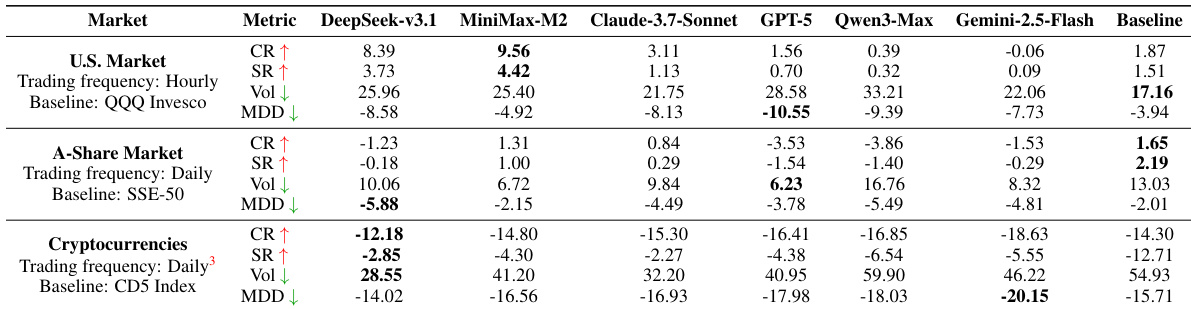

- Evaluated AI trading agents across U.S. equities, A-shares, and cryptocurrencies using daily (A-shares, crypto) and hourly (U.S. equities) strategies, assessing performance on cumulative return, Sortino ratio, volatility, and maximum drawdown.

- MiniMax-M2 achieved the highest cumulative return of 9.56% in the U.S. market (vs. QQQ’s 1.87%) with a Sortino ratio of 4.42 and maximum drawdown of -4.92%, demonstrating superior risk control and robustness across markets.

- DeepSeek-v3.1 outperformed the CD5 Index in the crypto market (-12.18% vs. -14.30%) by maintaining a high cash position (up to 41%) and executing strategic buy-the-dip trades, highlighting its adaptability in high-volatility environments.

- GPT-5, Qwen3-Max, and Gemini-2.5-Flash underperformed across all markets, with GPT-5 recording a cumulative return of 1.56% in the U.S. market and -16.41% in crypto, underscoring the gap between general language capabilities and effective trading.

- Model generalization is limited: DeepSeek-v3.1 excelled in the U.S. market (8.39% CR) but failed in A-shares (-1.23% CR), while MiniMax-M2 maintained consistent performance across all markets, indicating context-aware adaptability is critical.

- Case studies revealed that agents can emulate human-like behavior—DeepSeek-v3.1 successfully avoided a major U.S. market crash by diversifying into defensive sectors and increasing cash, but later underperformed due to unverified news, exposing weaknesses in information verification.

The authors use a multi-market, multi-frequency experimental design to evaluate AI trading agents across U.S. equities, A-shares, and cryptocurrencies, with performance measured using cumulative return, Sortino ratio, volatility, and maximum drawdown. Results show that MiniMax-M2 achieves the highest cumulative return and Sortino ratio in the U.S. market and remains the only consistently profitable agent in the A-share market, while DeepSeek-v3.1 outperforms the baseline in cryptocurrencies due to effective cash management and strategic trading during downturns.

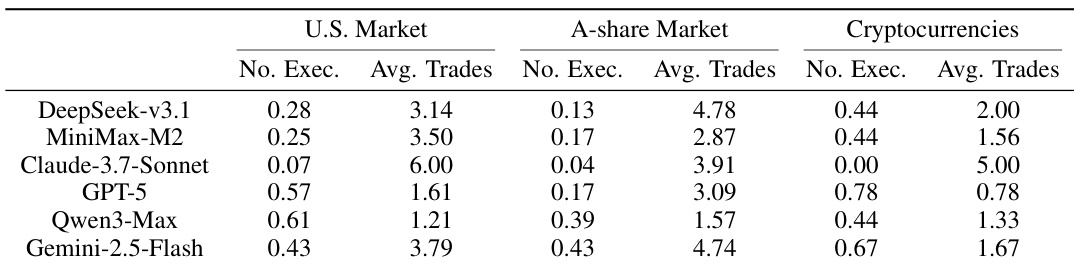

The authors use the table to compare the trading behavior of different AI models across three markets, showing that MiniMax-M2 executes trades less frequently than most other models, with the lowest proportion of no-trade executions in the U.S. and A-share markets. DeepSeek-v3.1 and Claude-3.7-Sonnet exhibit higher average trade counts in the U.S. and A-share markets, indicating more active trading strategies, while Gemini-2.5-Flash shows the highest average trades in cryptocurrencies, reflecting its more aggressive approach in that volatile environment.