Command Palette

Search for a command to run...

YouTube Founder Steve Chen Founded a Hedge Fund With AI Decisions

Let AI manage your money? This is a decision made jointly by professional hedge funds and Silicon Valley startup legends. They hope to use the infinite possibilities of AI to allow technology to create more direct wealth.

In the secondary investment market, there are many myths about how to make money. Fund managers with brilliant performance, economists with great maneuvers, and legendary retail investors with a long history of experience all have their own investment logic.

So, are you interested in investment decisions recommended by AI?

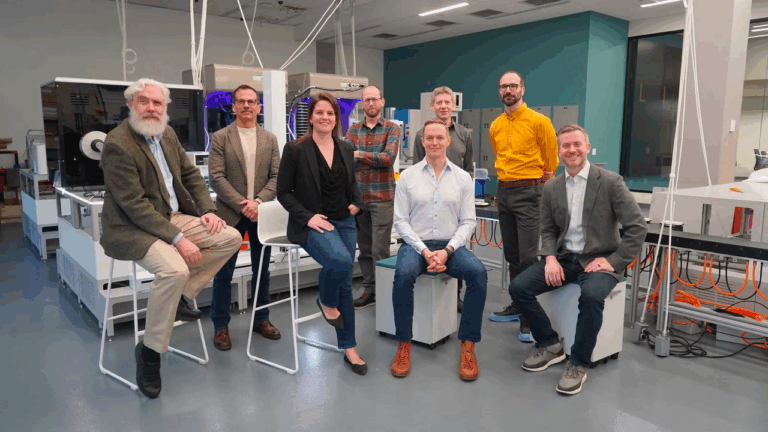

YouTube co-founder Steve Chen teamed up with veteran fund manager Jack Fu to launch an AI-powered hedge fund in September this year, which has raised $50 million so far.

Investing in AI: The choice of fund elites and Silicon Valley legends

The fund (Draco Capital Macro Quant Fund) was officially launched in September this year. The current goal of this hedge fund is to reach a scale of US$200 million by the end of 2021.

Chen Shijun said, "At present, this investment decision-making system has integrated a lot of machine learning and big data processing capabilities. These technical capabilities have been verified in the companies where I have worked or served as a consultant."

“In bullish markets, it has tended to pick large-cap tech names like Apple and Microsoft, while in bearish markets, it has been more focused on overweighting defensive assets like gold and long-term Treasury bonds.”

Chen Shijun feels that the current "investment decision-making system" has improved the accuracy of decision-making. He believes that this means combining economic analysis and investment logic with computer algorithms to create an artificial intelligence-driven decision-making model. He added that this is done to reduce the risk of economic downturn. "

Jack Fu, another partner of the fund, said, “So far, our investment decision-making AIWe are now able to use data to make mature market forecast indicators and adjust positions and shares accordingly."

AI investment, broad vision, and calm decision-making

The reason why AI has been tried and recognized in investment decision-making is mainly because of its "maturity and stability" that distinguishes it from humans.

AI can make full use of massive amounts of data to analyze the investment market and assist in decision-making. Not only that, AI machines also have the ability to invest automatically.

AI can also explore trading strategies on its own, learn autonomously from past failures and successful experiences, and learn the trading models of different investors through historical data to find the optimal trading strategy in mutual competition.

Also important is thatAI does not have the human weaknesses of greed, fear, hesitation, etc., nor is it affected by emotions.These will help make more accurate investment decisions.

Yjam Plus, an investment trust company under Yahoo (Japan), has been using artificial intelligence for investment since 2016.In one year, it created a return rate of 18%.However, staff member Hiroi said that after using AI to assist in investment for more than two years, he still did not understand the basis for its recommendations. The inexplicability of AI's black box decision-making is also a problem.

In China, this type of investment decision-making AI is now not only used in the professional investment field, but ordinary people can also participate. Domestic companies such as Alipay and Tenpay have launched AI to judge users' investment risk tolerance and wealth appreciation needs, and match corresponding investment strategies.

Shen Jing Xingxing said that he is very interested in investing in AI and wants to give it a try, but now he only lacks the capital.

News Source:

Fobes"YouTube Cofounder Steve Chen Launches Hedge Fund That Uses AI To Make Investment Decisions"

Red Star News Reference AI investment? Industry: Still unable to understand the decision-making basis of artificial intelligence》

Sina Finance Li Yimei of China Asset Management: Artificial intelligence has great potential in investment decision-making