Command Palette

Search for a command to run...

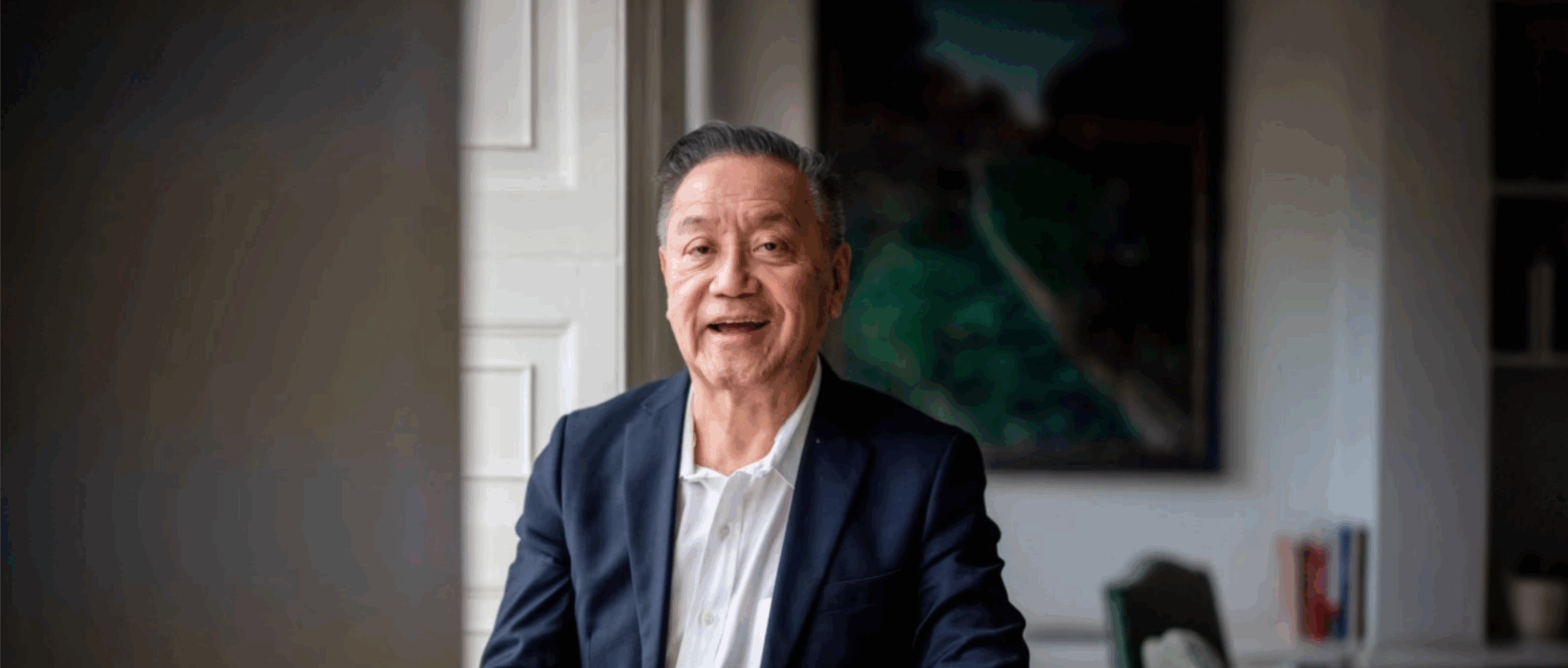

The 63-year-old Masayoshi Son's "Sixty-year Adventure"

Recently, the news about SoftBank selling ARM to pay off debts has been reported by major media, especially the recent news that NVIDIA may acquire ARM for 40 billion pounds, which caused an uproar in the industry. Masayoshi Son seems to have a bad luck and has been doing unprofitable business, and it seems that the signs appeared in 2016.

In recent days, news has been reported that NVIDIA will acquire ARM for 40 billion pounds. While many media outlets are scrambling to report on the progress of the acquisition, they are also putting the man behind the entire transaction - Masayoshi Son - in the spotlight.

SoftBank CEO, legendary investor, adventurer, Internet tycoon, world's richest man, Asian Buffett...

The 63-year-old Masayoshi Son has many brilliant achievements in his past life.The experience and foundation accumulated over the past decades have not been able to prevent SoftBank from suffering a series of failures in the past five years.

SoftBank is a company with a strong spirit of adventure in its bones, and it also has Masayoshi Son’s personal personality traits.

In the past five years when the Internet has become more stable and calm, without braking or slowing down, the soaring speed has brought not only blood-pumping passion, but also accidents that are difficult to avoid.

The beginning of the failure: borrowing money to acquire ARM and gambling on the future

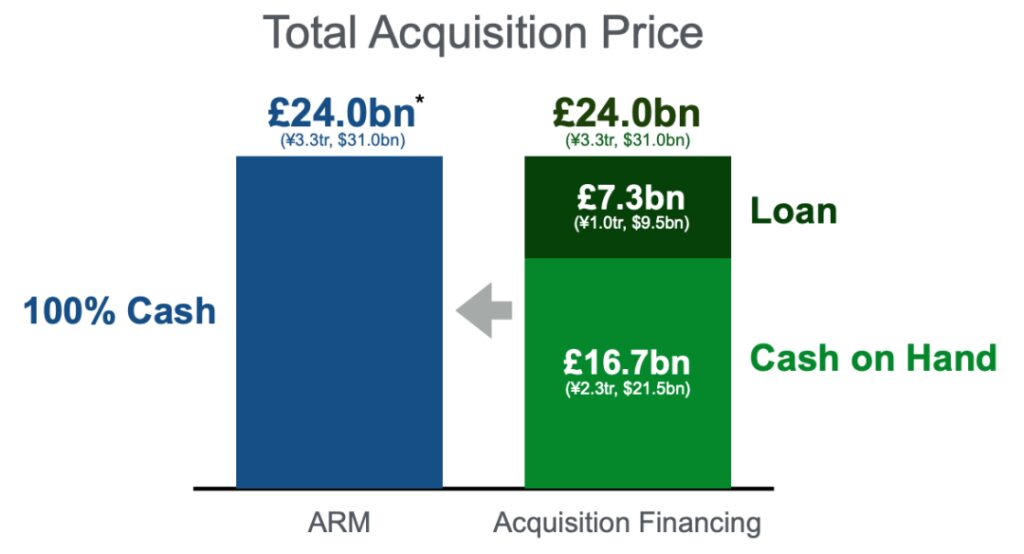

In July 2016, when Masayoshi Son was 59 years old, SoftBank acquired chip design company ARM for $32 billion.This has also become SoftBank's largest acquisition in recent years.

At the press conference, Masayoshi Son, who was full of expectations for the acquisition, said that the transaction would be settled in cash.To complete the acquisition, SoftBank also needs to borrow $9.5 billion.

Data source:

SoftBank & ARM Official Strategic Agreement, July 2016

As of the end of March 2016, the official financial statements showed that SoftBank's debt had reached US$108.2 billion, and the former richest man became the biggest loser.

In order to acquire ARM, the company added another $9.5 billion in debt. In the view of Masayoshi Son, an investor known for his radicalism and risk-taking, people with high debts tend to be bold, so it is better to take a chance.

However, ARM, which was acquired with debt, did not deliver results that satisfied Masayoshi Son, and the Internet of Things, which was highly anticipated, did not bring positive cash flow to SoftBank in a short period of time.

Nearly 90% of ARM's revenue comes from licensing fees and royalties, but according to data provided by market analysis company IPnest, ARM's market share of licensing fees and royalty revenue has declined year by year from 2017 to 2019.

Although ARM still has an absolute advantage in market share, the overall market is becoming saturated. Coupled with the continued development of similar products, ARM can no longer ignore these "latecomers".

In addition, SoftBank has been aggressively recruiting researchers in recent years and increasing its investment in the research of the Internet of Things, Internet of Vehicles, and smart wearable devices. However, the increase in labor costs has not generated actual economic value in the short term. The Internet of Things business, which SoftBank has high hopes for, has also not been satisfactory, and the development speed is far lower than expected.

On the one hand, the revenue from conventional business has been on a downward trend, and on the other hand, the new business continues to burn money with little effect.Masayoshi Son's "big gamble" has made ARM a hot potato in SoftBank's hands.

SoftBank also suffered losses: it was eager to get out of the predicament and missed the rebound opportunity

In May 2017, when Masayoshi Son turned 60, SoftBank purchased $4 billion worth of NVIDIA stock.This is equivalent to holding 4.9%, making it the fourth largest shareholder of NVIDIA.

Since November 2018, due to the collapse of virtual currencies, the weak performance of the RTX 20 series of new products, and the poor economic environment,NVIDIA's stock price continues to plummet.

According to Bloomberg: In January 2019, SoftBank sold all of its NVIDIA shares in an attempt to stop losses.

Although the official did not disclose the selling price, a look at NVIDIA's stock prices over the years shows that the price at which SoftBank sold was not much different from the price at which it bought it in 2017.This means that SoftBank did not make any money during this wave of NVIDIA shareholding, and may even have lost money.

Just after SoftBank sold all of its NVIDIA shares, NVIDIA's stock price has soared to the present day, reaching $453.

Masayoshi Son, the Asian Buffett, must be regretting his decision.Leaving the market too early did not allow SoftBank to stop losses in time, but instead lost the opportunity to double its assets.

Crash and heavy losses: Vision Fund becomes the biggest drag

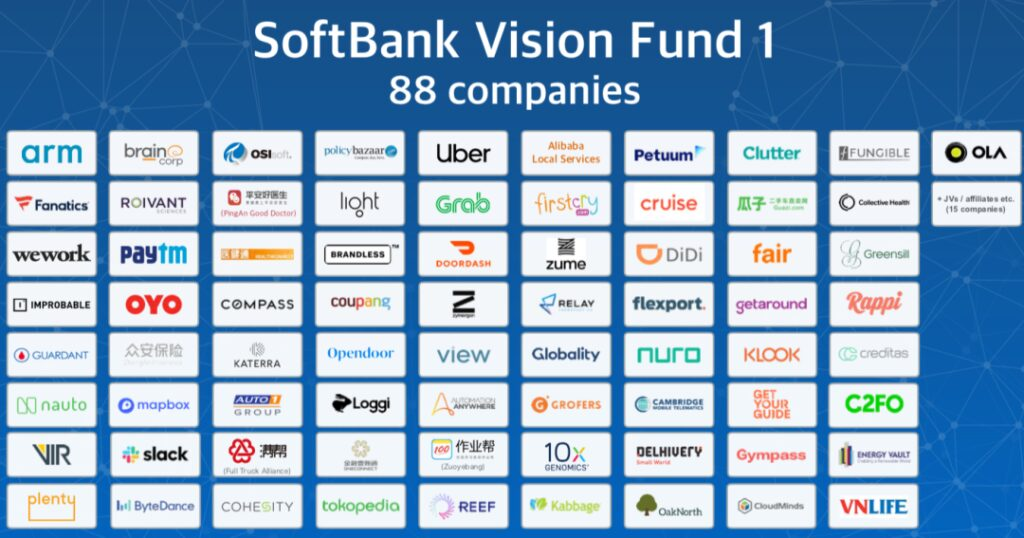

In 2017, when Masayoshi Son was 60 years old, he established the Vision Fund.This $100 billion fund, which carries Masayoshi Son’s great business dream, has not brought SoftBank huge and gratifying business returns and a bright future as its name suggests.Instead, it dragged SoftBank into a spiraling debt abyss.

From 2017 to 2019,SoftBank and Vision Fund invested nearly $11 billion in WeWork, a shared office space, in multiple installments.Owns nearly 30% of the company's equity.

At its peak, WeWork's valuation was as high as US$47 billion. In September 2019, WeWork's original IPO was blocked and its valuation was halved to US$23.1 billion.

According to SoftBank’s financial report released in May this year, WeWork’s current valuation is only US$2.9 billion.From $47 billion to $2.9 billion, WeWork contributed $4.6 billion in losses to SoftBank.

WeWork is not the only company that Son has misjudged. In 2018, SoftBank paid US$9.3 billion for 15% of Uber's shares. The company was valued at US$120 billion before its IPO. However, its growth has been weak since its IPO. As of press time, Uber's market value is only US$57.4 billion.

In fiscal 2019, the Vision Fund contributed the largest deficit to SoftBank, about 1.9 trillion yen (about 17.7 billion U.S. dollars).Among them, WeWork and Uber brought losses of 4.6 billion and 5.4 billion respectively, accounting for 55% of the total losses.

Other projects invested by the Vision Fund have suffered heavy losses in the pandemic since the beginning of 2020.About 15 of the 88 companies went bankrupt.

February 2020 Brandless, the US "Pinduoduo", officially announced its bankruptcy, which is also the first dead project since the establishment of the Vision Fund. With the bankruptcy of Brandless, Masayoshi Son's investment of $100 million went down the drain.

March 2020 SpaceX's competitor OneWeb officially announced that it had filed for bankruptcy protection. As OneWeb's largest investor, SoftBank led two rounds of investment, injecting a total of $2 billion. Masayoshi Son's investment project failed again.

June 2020 German payment giant Wirecard filed for bankruptcy. Masayoshi Son invested more than $1 billion in Wirecard by purchasing its convertible bonds in April 2019, and now this investment is undoubtedly gone.

The Vision Fund, which carries Masayoshi Son's dream of a business empire, has invested in a series of failed projects, with hundreds of billions of dollars in investment yielding little results, and many projects have never paid off.

Selling stocks and ARMs, the landlords have no more food left

Looking back from 2016 to now, the radical investment guru Masayoshi Son seems to be stuck in an investment vicious circle, with repeated attempts failing.

Now 63 years old, Masayoshi Son is racking his brains to make up for SoftBank's financial losses.After selling Alibaba shares, Sprint, T-Mobile, and Treasure Data to cash out, it finally turned to ARM reluctantly..

As an aside, a fortune teller on the Internet analyzed Masayoshi Son's birth date and said that in 2016, Masayoshi Son will be in a state of officialdom and will suffer financial losses and bad luck. He will be under great pressure in 2020, and his luck will come together in 2021, which will be the most unlucky year.

The fortune teller also predicted that starting from 2025, Son's fortune would become extremely difficult and he would have more debts.Advised Masayoshi Son to "retire early so that he can live a more comfortable life."

Neither metaphysics nor industry analysis is sufficient to influence and speculate the final outcome. Even the current transaction between ARM and NVIDIA is unlikely to be certain.

Where will ARM, the British company that carries Masayoshi Son’s IoT empire ambitions, go in the end?

Who can say for sure whether Masayoshi Son, who is in his sixties, can escape from the jaws of death this time?

refer to:

https://group.softbank/en/ir/presentations?year=2019&news-category=on#202005180000

-- over--